Self-employed persons in Germany are obliged to pay tax on their income and submit an annual income tax return. But that's not all: there are also a few additional forms that you have to fill out and submit when completing your tax return.

In this article, we shine some light on these different forms and explain when you have to fill out which annex.

As a self-employed person in Germany, you are required by law to file an income tax return every year. This consists of the so-called "Mantelbogen", or main form, in which you enter general information about yourself, as well as a few additional attachments, which can vary from person to person.

You must provide the following information in the main form:

➡️ You can find more information on how to complete your German income tax returns here.

In addition to the information on the main form, self-employed persons must fill out various other forms and submit them with their income tax return.

If you have opted for the income surplus statement (and not for the far more complex double-entry bookkeeping) when registering your self-employed activity, then you are obliged to submit the so-called EÜR (Einnahmenüberschussrechnung) annex.

➡️ You can find more information about the Einnahmenüberschussrechnung here

In this form, you compare your business income with your business expenses and thus determine the profit that you have generated with your self-employment.

➡️ We have created a step by step guide to help you submit your EÜR here!

If you are considered to be a freelancer by the Finanzamt, you must also fill out the Annex S in addition to the Annex EÜR. This form is used to additionally explain the information given in the surplus income statement and thus make your income more comprehensible for the Finanzamt.

In this form, you must include the pre-calculated profit from your EÜR, as well as declare losses, additional profits from other activities or capital gains and, if applicable, profit shares from partnerships operating on a freelance basis.

If you are not a freelancer but a tradesperson, you must fill out the Annex G instead of the Annex S. Other than that, the information in this form is pretty much identical in content to the annex S for freelancers.

This form also serves to explain your profit from your work in more detail and to make the information from the surplus income statement more comprehensible.

➡️ If you are not sure whether you are considered a tradesperson or a freelancer, you can find more information in this article

Another attachment that is potentially interesting for you is the KAP annex, in which you declare income from capital gains. Capital gains is income from interest, loans or the sale of shares. Since 2009, you have to pay 25% final withholding tax on this income.

This final withholding tax is usually paid automatically by your bank or financial institution, but in some cases, it may still be mandatory to fill out this form. In addition, there are also a few ways in which you can save some money by voluntarily filing this annex.

In addition to these annexes, you may also have to prepare and file an annual VAT return. This is obligatory if you are subject to VAT (value added tax), or Umsatzsteuer in German. Registered Kleinunternehmer (small entrepreneurs) are exempt from submitting an annual VAT return.

➡️ Don't worry, the VAT return is not that difficult! This is how easy you file your German VAT return!

In the annual VAT return, you must list all VAT amounts paid in the year.

💡The annual VAT return must be submitted in addition to the regular VAT returns, which you must submit monthly or quarterly, depending on the requirements of the Finanzamt.

Additionally, if you are considered a Gewerbe (tradesperson), you must also submit an annual trade tax return. This again is similar to the annual VAT return: you have to list the total amount of trade tax you have paid, which you pay to the Finanzamt in advance on a quarterly basis over the course of the year.

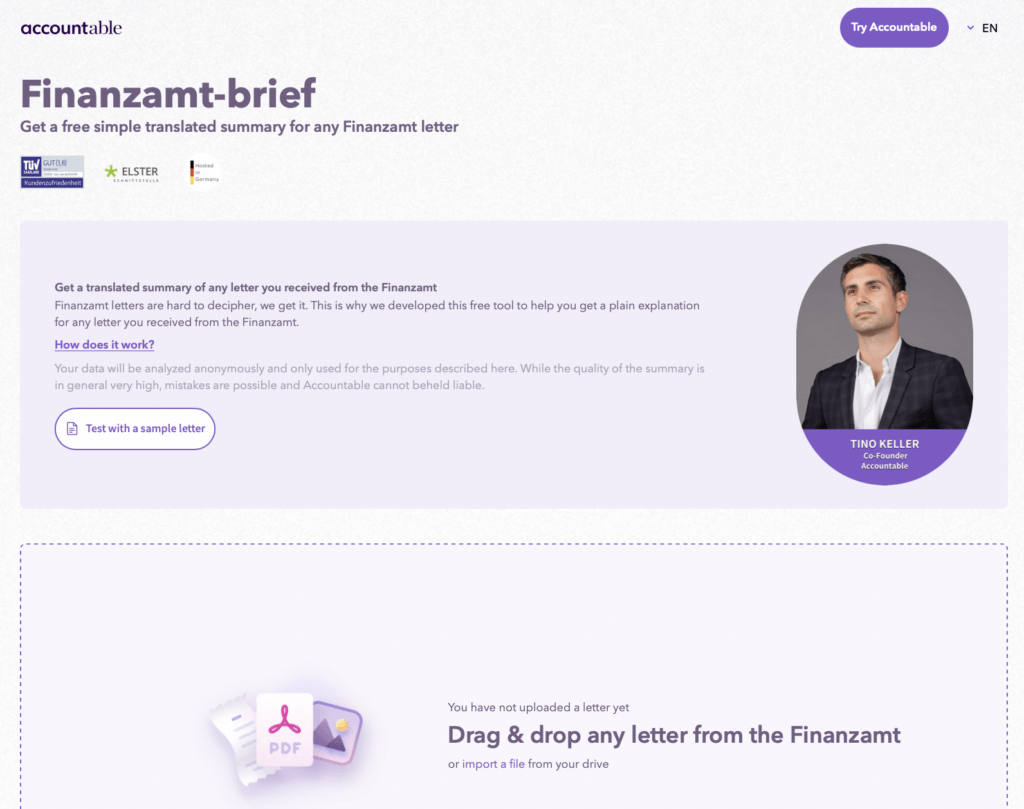

Use our free AI tool! Just upload the letter and it will analyze and translate it's content for you!

💡Accountable is the tax solution for the self-employed. Download the free app or create an account online. This way, you have your bookkeeping and tax obligations like VAT return under control right from the start. Our team will also help you personally in the chat at any time!

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Tino Keller

Tino Keller is the Co-founder behind Accountable, driven by a mission to revolutionize how freelancers, self-employed professionals, and small business owners manage their taxes.

Who is Tino ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read moreFür mich als Kleinunternehmer ist der Preis ein bisschen hoch, aber für alles, was ich bekomme: alle Übersichten von Einnahmen und Ausgaben, die Funktionen rund um das Auto... ist es einfach top. Und das letzte Update zu den wiederkehrenden Ausgaben war hervorragend! Dankeschön.

Ardalan Zamanimehr

Die App ist super! Intuitiv und perfekt für Selbstständige. Leider ist meine Position noch zu exotisch für Accountable um genau diese Leichtigkeit auch in Anspruch zu nehmen. Es gibt noch keine einfache Lösung für Selbstständige mit zwei Steuernummern da zwei Berufe. Sollte sich das mal ändern, Wechsel ich von meinem Steuerberater wieder zu Accountable!

Viktor Rosin

Sehr freundlich und gezielte , verständliche Angaben und Erklärungen

Pascal Koopmann

Auf meine Anfrage habe ich sehr schnell eine sehr nette und kompetente Antwort bekommen. Die Mitarbeiterin hat mein als Verbesserungsvorschlag weitergegeben - und schon nach kurzer Zeit kam die Antwort, dass das entsprechende Feature eingearbeitet wurde. Tolle Arbeit!

Dr. Annika Krummacher

Sehr nette und kompetente Beratung - vielen Dank!

Annika Schirmer

Sehr gute App sehr einfach zu verstehen und leichte Bedienung

Johannes Sen

Schnelle Antwort mit Hilfestellung die das Problem sofort gelöst hat. Danke

Albert Friedrich Vontz

Meine Erfahrung mit Accountable ist wirklich klasse! Alles ist sehr übersichtlich und gut strukturiert und das Wichtigste: es funktioniert wie es soll! Es gibt online Webinare, einen KI Steuerberater der Zugriff auf die persönlichen Dokumente hat und die Steuer Coaches von welchen ich extrem begeistert bin. Sehr klare, ausführliche, vorausschauende und freundliche Antworten auf meine Fragen. Als selbsständiger Dienstleister fühle ich mich sehr gut aufgehoben und kann Accountable nur empfehlen.

Sven Schöffel

Ich finde es gut, dass ich als Kunde des Max Plans jetzt deutlich schnellere Antworten bekomme. Das war eine Zeit lang nicht zuverlässig so, umso positiver fällt mir die Verbesserung auf. Die Steuer Coaches sind stets bemüht zu helfen. Sie antworten freundlich, klar und lösungsorientiert. Ich bin damit wirklich sehr happy. Für mich war es außerdem die beste Entscheidung, meine Steuer selbst zu machen. Ich habe jetzt mehr Überblick über meine Zahlen und verstehe die Abläufe besser. Dadurch fühle ich mich deutlich sicherer, auch in der Kommunikation mit den Steuerbehörden. Ich kann Rückfragen schneller einordnen und gezielter reagieren. Das nimmt mir viel Stress und gibt mir das Gefühl, die Kontrolle zu haben. Der Live Call ist ein sinnvoller Zusatz. Du kannst offene Punkte direkt klären, ohne lange hin und her zu schreiben. Das spart Zeit und bringt schnell Klarheit. Fazit: Liebs 😊

Marco Richter

Top Team! Top Service!

Anonym