Managing taxes can be a daunting task, especially for self-employed professionals in Germany. From understanding complex regulations to navigating through tax procedures, knowing you have someone to support you can save you a lot of worries and stress.

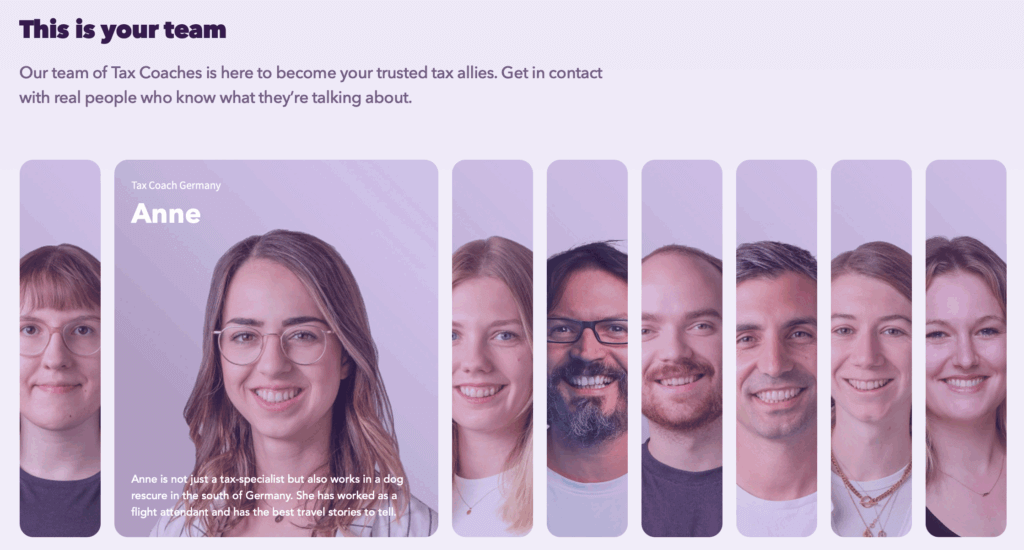

At Accountable, we understand these challenges and offer a solution with our team of dedicated Tax Coaches. In this article, we will show you how our Tax Coaches will support you in your tax journey and how they help to make bookkeeping and taxes smoother and more manageable for you.

💡Tip from Accountable: Accountable is a tax software designed for freelancers and Gewerbetreibende (trade persons) in Germany. It covers all the bookkeeping and tax obligations and is available as app and on web. Test it now for free!

Tax matters can be complicated, and the last thing you need is a barrage of technical jargon and ambiguous explanations. Accountable's Tax Coaches are aware of this and will simplify complex concepts and provide practical help in plain English. Also, instead of vague statements like "it depends," they offer actionable guidance that you can easily understand and act upon. With this clear communication, we want to help you make informed decisions and stay in control of your tax obligations.

Accountable's Tax Coaches provide basic tax knowledge, but they also specialise in helping you navigate and utilise the full potential of the Accountable software. From explaining how to write correct invoices in the app to offering tips on how to save taxes, our Tax Coaches ensure that you have a comprehensive understanding of the software's features and capabilities.

For example, if you're unsure about the correct category for an expense, they are there to confirm or suggest the appropriate classification. They can also assist you in understanding numbers, tax computations, and interpreting letters from the Finanzamt (tax office).

💡Have a burning tax question in the middle of the night? You can always ask the Accountable AI Tax Advisor. It provides

Unlike traditional tax advisors who often leave unanswered emails or struggle with follow-ups due to high client demand, our Tax Coaches ensure that you receive a personal answer to your questions within 24 hours. We do our best to offer you prompt and personalised support, that's why you can contact us through email and chat-messaging or even schedule a free phone call or a one-on-one video call in some of our paid plans.

Furthermore, at Accountable, we value user feedback and actively collaborate with our development team to optimise the app based on your suggestions.

When you encounter issues or face challenges with tax-related matters, Accountable's Tax Coaches are committed to finding solutions. They don't give up until the problem is resolved. In contrast, tax advisors might struggle with proactively addressing your concerns due to their workload. With our Tax Coaches, even when it takes some time, you can rely on the persistence and dedication of the whole team, including our developers if needed, to ensure that you receive a solution to your problem.

In addition to one-on-one support, Accountable offers free webinars that cover a variety of tax topics relevant to freelancers and Gewerbetreibende in Germany. These live sessions are designed to give you actionable insights, step-by-step guidance, and practical tips straight from our Tax Coaches.

Whether you simply want to understand how taxes work in Germany, optimise your tax savings or learn how to get the most out of the Accountable app, our webinars make complex topics easier to grasp. Plus, you can ask questions in real-time and get direct answers from the experts.

Attending these webinars is a great way to boost your confidence, stay up-to-date with tax regulations, and connect with a community of freelancers navigating the same challenges.

While the Accountable Tax Coaches offer comprehensive support, it's important to understand their limitations. They aren't certified tax advisors and thus can't offer official tax advice. While the Tax Coaches offer extensive support, they do not provide tax or legal advice. In such cases, they will guide you towards certified tax advisors to address your specific needs.

They also do not encode your documents, review your accounting, submit your taxes on your behalf, contact the Finanzamt (tax office) in your name, perform tax computations, or handle the registration process for self-employment.

However, you can ask about any of those topics and our Tax Coaches will suggest next steps or get you in contact with the right person for your issue. For example, should you require official tax advisory services and you are a user of Accountable, they will connect you with certified tax advisors who possess the necessary qualifications and expertise.

At Accountable, we want to provide more than just tax software for freelancers. We want to give you the personal support and feeling of security that software can't offer. With their actionable assistance, software support and commitment to resolving issues, our Tax Coaches provide personalised guidance to help you manage your taxes with confidence.

By leveraging their expertise and the Accountable software, you gain a better understanding of tax regulations and don't have to be afraid of mistakes.

Already have a question? Send us a message!

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Tino Keller

Tino Keller is the Co-founder behind Accountable, driven by a mission to revolutionize how freelancers, self-employed professionals, and small business owners manage their taxes.

Who is Tino ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read moreFür mich als Kleinunternehmer ist der Preis ein bisschen hoch, aber für alles, was ich bekomme: alle Übersichten von Einnahmen und Ausgaben, die Funktionen rund um das Auto... ist es einfach top. Und das letzte Update zu den wiederkehrenden Ausgaben war hervorragend! Dankeschön.

Ardalan Zamanimehr

Die App ist super! Intuitiv und perfekt für Selbstständige. Leider ist meine Position noch zu exotisch für Accountable um genau diese Leichtigkeit auch in Anspruch zu nehmen. Es gibt noch keine einfache Lösung für Selbstständige mit zwei Steuernummern da zwei Berufe. Sollte sich das mal ändern, Wechsel ich von meinem Steuerberater wieder zu Accountable!

Viktor Rosin

Sehr freundlich und gezielte , verständliche Angaben und Erklärungen

Pascal Koopmann

Auf meine Anfrage habe ich sehr schnell eine sehr nette und kompetente Antwort bekommen. Die Mitarbeiterin hat mein als Verbesserungsvorschlag weitergegeben - und schon nach kurzer Zeit kam die Antwort, dass das entsprechende Feature eingearbeitet wurde. Tolle Arbeit!

Dr. Annika Krummacher

Sehr nette und kompetente Beratung - vielen Dank!

Annika Schirmer

Sehr gute App sehr einfach zu verstehen und leichte Bedienung

Johannes Sen

Schnelle Antwort mit Hilfestellung die das Problem sofort gelöst hat. Danke

Albert Friedrich Vontz

Meine Erfahrung mit Accountable ist wirklich klasse! Alles ist sehr übersichtlich und gut strukturiert und das Wichtigste: es funktioniert wie es soll! Es gibt online Webinare, einen KI Steuerberater der Zugriff auf die persönlichen Dokumente hat und die Steuer Coaches von welchen ich extrem begeistert bin. Sehr klare, ausführliche, vorausschauende und freundliche Antworten auf meine Fragen. Als selbsständiger Dienstleister fühle ich mich sehr gut aufgehoben und kann Accountable nur empfehlen.

Sven Schöffel

Ich finde es gut, dass ich als Kunde des Max Plans jetzt deutlich schnellere Antworten bekomme. Das war eine Zeit lang nicht zuverlässig so, umso positiver fällt mir die Verbesserung auf. Die Steuer Coaches sind stets bemüht zu helfen. Sie antworten freundlich, klar und lösungsorientiert. Ich bin damit wirklich sehr happy. Für mich war es außerdem die beste Entscheidung, meine Steuer selbst zu machen. Ich habe jetzt mehr Überblick über meine Zahlen und verstehe die Abläufe besser. Dadurch fühle ich mich deutlich sicherer, auch in der Kommunikation mit den Steuerbehörden. Ich kann Rückfragen schneller einordnen und gezielter reagieren. Das nimmt mir viel Stress und gibt mir das Gefühl, die Kontrolle zu haben. Der Live Call ist ein sinnvoller Zusatz. Du kannst offene Punkte direkt klären, ohne lange hin und her zu schreiben. Das spart Zeit und bringt schnell Klarheit. Fazit: Liebs 😊

Marco Richter

Top Team! Top Service!

Anonym