Creating legally compliant e-invoices requires a structured, machine-readable data format. To fully benefit from e-invoices, self-employed individuals in Germany should consider using accounting or invoicing software that meets legal standards. Popular options include Accountable, sevDesk, and Lexoffice.

Our comprehensive comparison helps you identify the best e-invoicing software available today.

While electronic invoices can be created in various ways, not all electronically generated invoices qualify as standardized e-invoices. For compliance, the invoice must use a structured, machine-readable format. Accounting and invoicing software is highly recommended for freelancers, self-employed individuals, and small to medium-sized enterprises to meet the new requirements starting in 2025.

E-invoicing tools generally offer key features such as:

💡Learn everything you need to know about the e-invoicing requirements in Germany here!

The need for legally compliant e-invoicing is becoming increasingly important for businesses of all sizes, as well as freelancers and self-employed individuals. Currently mandatory for B2G (business-to-government) invoices, the upcoming Growth Opportunities Act made B2B e-invoicing obligatory in 2025.

Many software providers have adapted their solutions for e-invoicing. Popular programs include:

Accountable is a tax software specifically designed for freelancers and self-employed individuals. It offers a free plan to create and manage compliant e-invoices.

Accountable also manages all tax obligations and optimizes tax submissions through AI-powered tax advisor and tax coaches, ensuring that all declarations are error-free and successfully submitted to the tax office thanks to the Accountable tax guarantee.

The intuitive platform helps users effortlessly create invoices in the required XRechnung or ZUGFeRD formats or send them via PEPPOL. With its user-friendly interface and automated tax calculations, Accountable ensures compliance with all tax and legal requirements, such as the GoBD. These are the key features around e-invoicing:

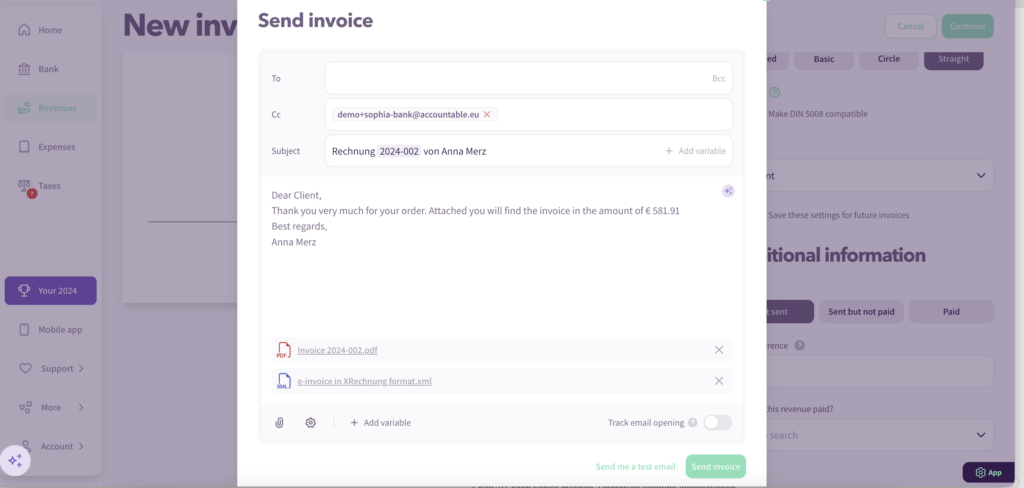

Accountable allows you to send e-invoices directly to clients via the platform. Invoices can be created and personalised as usual using the invoice template. Next, you can choose between the options “Save & Download XRechnung” or “Save & Send”. This enables you to send the invoice directly from Accountable. Simply select the “Attach XRechnung” function in the final step, and the e-invoice will be delivered to your client in the correct format. Alternatively, e-invoices can also be received and sent via the official PEPPOL network.

Yes, Accountable offers a free version for freelancers and self-employed individuals, allowing you to create e-invoices – including XRechnungen – completely free of charge. With Accountable, you can generate and download an unlimited number of e-invoices at no cost.

Additionally, Accountable offers a paid PRO version, which enables you to prepare and submit all tax declarations. Learn more here.

Pricing

Accountable is primarily designed for freelancers, solo entrepreneurs, and small business owners who are looking for a simple and legally compliant solution to manage their bookkeeping and tax obligations. The platform is tailored for users with little to no prior tax knowledge, enabling them to confidently and independently handle their finances.

Accountable aims to empower all self-employed individuals to manage their tax filings and accounting tasks—such as creating e-invoices and calculating taxes—without needing a tax advisor. It is also an excellent option for small business owners who value mobility and flexibility, as the platform is available both as a web version and a mobile app.

➡️ Try Accountable for free and create your first e-invoice today!

SevDesk is an accounting software tailored for freelancers and small businesses. It supports digitalizing your bookkeeping and includes functionality for e-invoicing.

Key Features

Pricing

Best For

Freelancers, agencies, and retailers looking for a robust solution that includes accounting, CRM, and mobile integration.

Lexoffice offers an expansive range of features, combining invoicing, bookkeeping, and inventory management.

Key Features

Pricing

Best For

Freelancers and businesses with diverse needs, including inventory management and advanced workflow automation.

FastBill simplifies the automation of your invoicing and bookkeeping processes.

Key Features

Pricing

Best For

Freelancers and growing businesses focused on scalability.

Billomat offers a cloud-based solution for freelancers and SMEs to create e-invoices effortlessly.

Key Features

Pricing

Best For

Freelancers and small businesses looking for mobility and customization.

DATEV is widely used in tax consultancies and offers powerful cloud solutions for businesses.

Key Features

Pricing

Best For

Businesses of any size looking for a well-established accounting solution.

E-invoicing has become essential for public contracts and will be mandatory for B2B transactions in Germany starting in 2025. Therefore, you should prepare by using software for XRechnungen and other e-invoice formats. The best software depends on your specific needs:

➡️ Find the best invoicing software for your business and start simplifying your accounting today!

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Sophia Merzbach

Sophia has been a key member of the Accountable team for many years, bringing a unique blend of journalistic precision and in-depth tax expertise to her work.

Who is Sophia ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read moreFür mich als Kleinunternehmer ist der Preis ein bisschen hoch, aber für alles, was ich bekomme: alle Übersichten von Einnahmen und Ausgaben, die Funktionen rund um das Auto... ist es einfach top. Und das letzte Update zu den wiederkehrenden Ausgaben war hervorragend! Dankeschön.

Ardalan Zamanimehr

Die App ist super! Intuitiv und perfekt für Selbstständige. Leider ist meine Position noch zu exotisch für Accountable um genau diese Leichtigkeit auch in Anspruch zu nehmen. Es gibt noch keine einfache Lösung für Selbstständige mit zwei Steuernummern da zwei Berufe. Sollte sich das mal ändern, Wechsel ich von meinem Steuerberater wieder zu Accountable!

Viktor Rosin

Sehr freundlich und gezielte , verständliche Angaben und Erklärungen

Pascal Koopmann

Auf meine Anfrage habe ich sehr schnell eine sehr nette und kompetente Antwort bekommen. Die Mitarbeiterin hat mein als Verbesserungsvorschlag weitergegeben - und schon nach kurzer Zeit kam die Antwort, dass das entsprechende Feature eingearbeitet wurde. Tolle Arbeit!

Dr. Annika Krummacher

Sehr nette und kompetente Beratung - vielen Dank!

Annika Schirmer

Sehr gute App sehr einfach zu verstehen und leichte Bedienung

Johannes Sen

Schnelle Antwort mit Hilfestellung die das Problem sofort gelöst hat. Danke

Albert Friedrich Vontz

Meine Erfahrung mit Accountable ist wirklich klasse! Alles ist sehr übersichtlich und gut strukturiert und das Wichtigste: es funktioniert wie es soll! Es gibt online Webinare, einen KI Steuerberater der Zugriff auf die persönlichen Dokumente hat und die Steuer Coaches von welchen ich extrem begeistert bin. Sehr klare, ausführliche, vorausschauende und freundliche Antworten auf meine Fragen. Als selbsständiger Dienstleister fühle ich mich sehr gut aufgehoben und kann Accountable nur empfehlen.

Sven Schöffel

Ich finde es gut, dass ich als Kunde des Max Plans jetzt deutlich schnellere Antworten bekomme. Das war eine Zeit lang nicht zuverlässig so, umso positiver fällt mir die Verbesserung auf. Die Steuer Coaches sind stets bemüht zu helfen. Sie antworten freundlich, klar und lösungsorientiert. Ich bin damit wirklich sehr happy. Für mich war es außerdem die beste Entscheidung, meine Steuer selbst zu machen. Ich habe jetzt mehr Überblick über meine Zahlen und verstehe die Abläufe besser. Dadurch fühle ich mich deutlich sicherer, auch in der Kommunikation mit den Steuerbehörden. Ich kann Rückfragen schneller einordnen und gezielter reagieren. Das nimmt mir viel Stress und gibt mir das Gefühl, die Kontrolle zu haben. Der Live Call ist ein sinnvoller Zusatz. Du kannst offene Punkte direkt klären, ohne lange hin und her zu schreiben. Das spart Zeit und bringt schnell Klarheit. Fazit: Liebs 😊

Marco Richter

Top Team! Top Service!

Anonym