If you’ve already started freelancing in Germany, you’ll probably have come across one of the most bothersome tax obligations: the Umsatzsteuervoranmeldung (advance VAT return). Self-employed persons who are subject to VAT have to list their income from the previous months and pay the corresponding VAT to the tax office. It can be a confusing process and one that can attract costly fines if you miss a deadline or payment. Never fear! In this article, we take away the confusion and show you how easy it is to submit your advance VAT estimations on time every time with Accountable.

In Germany, for every product sold and every service provided, VAT (Value Added Tax) must be paid to the state. Just in case you need some more German tax terms in your life, this tax is also often referred to as 'Mehrwertsteuer' or 'Umsatzsteuer'.

The regular rate of VAT is 19% or 7%, depending on the type of service or product, which is added to the price of a purchase. This means that whenever you purchase goods or services, you pay VAT to the vendor. It also means that as a freelancer or self-employed person, you must charge VAT on the products and services you sell, and in turn, pay VAT to the Finanzamt (tax office).

In order to determine how much is owed, you have to submit various information to the tax authorities. Instead of submitting one VAT declaration for an entire tax year, you are obliged to submit regular advance VAT returns, in which an estimation is made each month or quarter of how much VAT you have charged, how much VAT you can deduct due to business expenses, and how much VAT you owe in your next VAT prepayment. The submission deadlines for your advance VAT returns are set by the Finanzamt and you will be advised of how regularly you must submit them. It's either monthly, quarterly or yearly.

Note: Even if you do not generate or charge any VAT in a given period, you must still submit an advance VAT return to indicate that the VAT you received was zero.

To balance any differences between the advance VAT returns and the pre-payments you make throughout a tax year, you must also submit a final VAT declaration (“Umsatzsteuerbescheid”) for each tax year.

The positive thing about the VAT return is that you can claim the VAT you have paid for via business-related expenses against the payments you make on the VAT you earned. This is especially beneficial if you often have larger expenses for machines or other equipment as part of your freelance business.

💡Tip from Accountable: If your total revenue in the previous calendar year was €25,000 or less and you do not exceed €100,000 in the current year, you can make use of the Kleinunternehmerregelung (small business regulation) and be exempt from paying and submitting VAT.

The easiest way to do it? By using Accountable. Available for free, the Accountable app is specifically designed to meet the needs of freelancers living in Germany — and it’s available in English!

If you organise your income and expenses with the Accountable app, you can automatically create your advance VAT return with just a few clicks, sending the data directly to your tax office.

We’ll walk you through the process, but if you run into any trouble you can troubleshoot from within the app itself.

Accountable is available for both iOS and Android, search for it on the App Store, or enter your phone number to get a download link sent directly to your phone.

After you have successfully installed the app, you can create your profile. Simply fill in your information such as your tax number, your VAT identification number and your job title and click to save.

Thanks to our receipt recognition feature, you can quickly upload all your expenses and invoices via photo making it easy to keep track of your cash flow. Your expenses are automatically categorized for tax purposes and can be exported to other software.

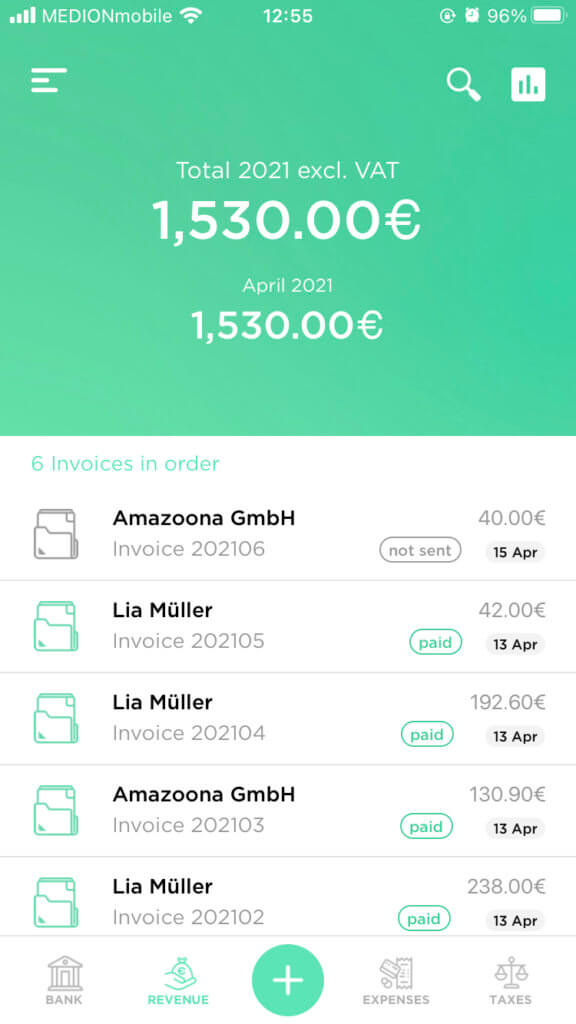

Enter new revenue

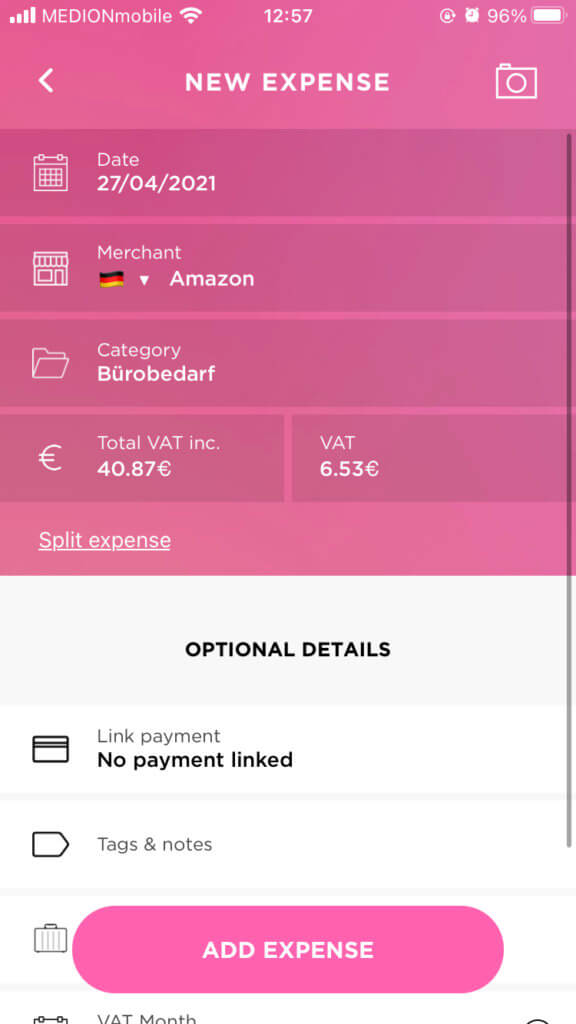

Create new expense

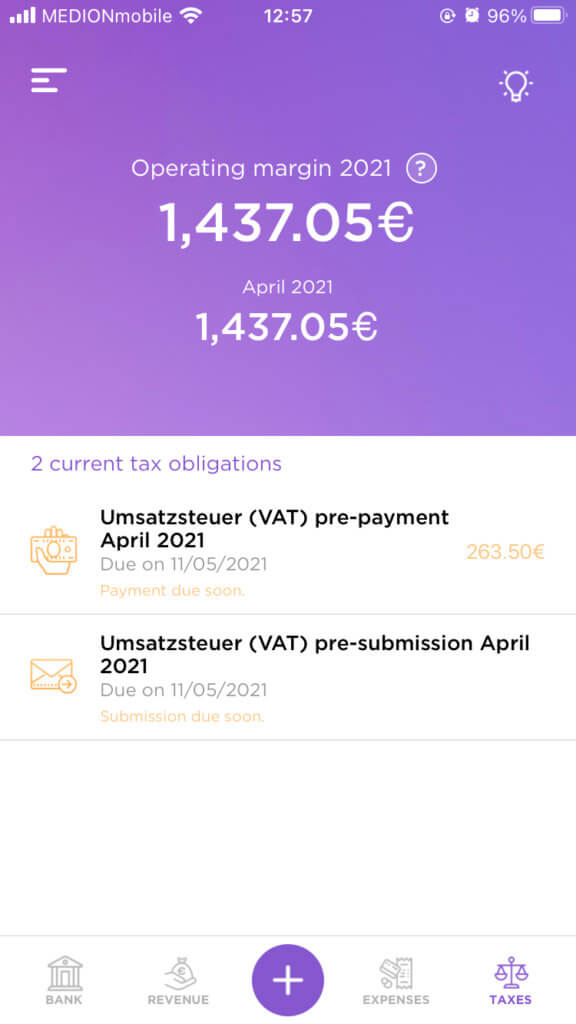

In the 'Taxe's tab you can find all relevant submission deadlines for your tax returns at a glance. You can also see when your next VAT return is due.

The amount of VAT you have to pay in advance is calculated from the income and relevant business expenses you've entered in the Accountable app.

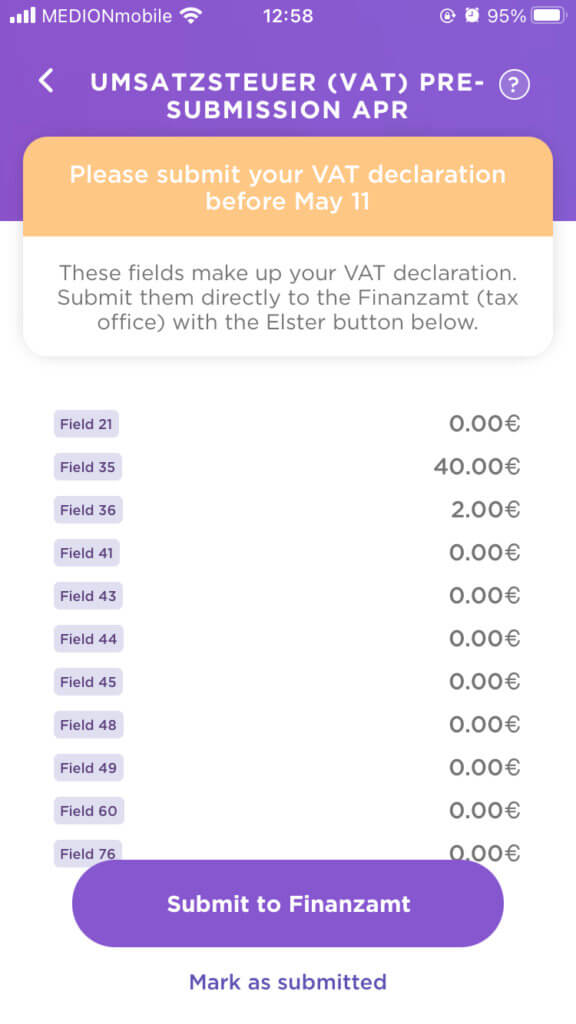

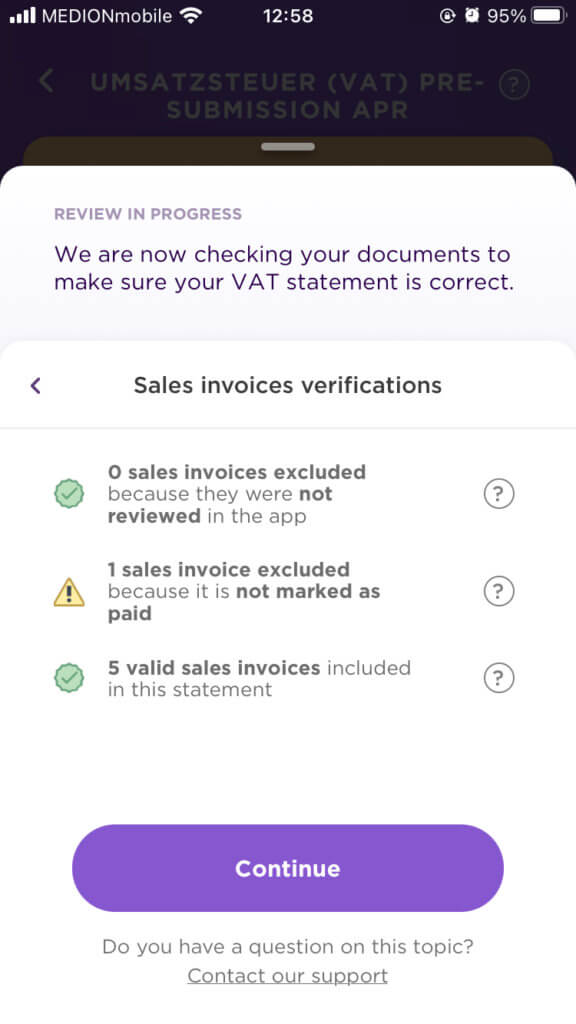

By clicking on the corresponding VAT return, you will find an overview of the relevant details, which Accountable submits directly to your Finanzamt via ELSTER. Click on "Send to tax office" to have your data checked once again.

As soon as you've checked and verified the information, you can send your VAT return directly to your Finanzamt. A copy of the transfer is automatically sent to your email address.

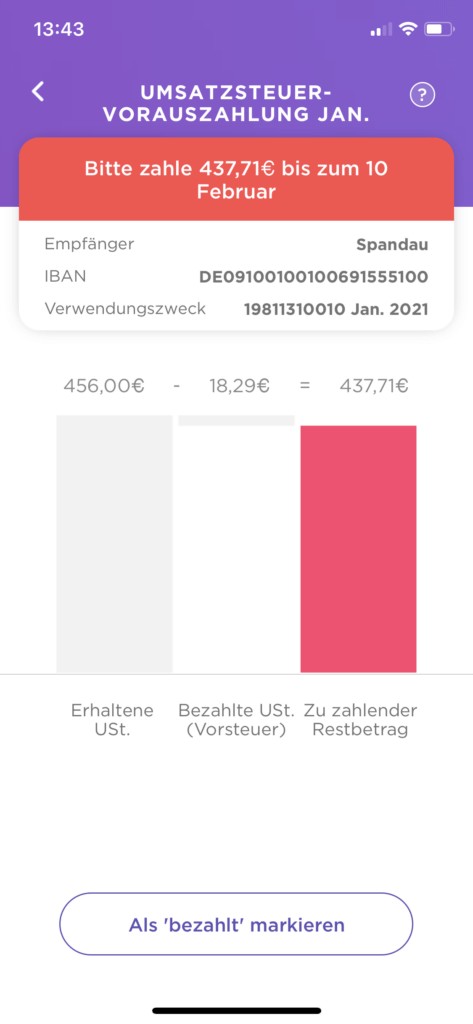

The last step for you is to transfer the VAT amount owed to your local Finanzamt. Accountable automatically calculates the amount for you, and also shows you the account details of your Finanzamt. How easy is that?

As soon as you have transferred the money, you can mark the VAT return for the relevant month as paid and fully concentrate on your work again!

We know it’s not always easy to understand everything in one go, which is why we’re trying to make things as easy as possible for you. The Accountable app can help you organise your invoices and expenses, and keep you on top of all your tax reporting obligations. For more information on any other topics relevant to your life as a foreigner freelancing in Germany, check out our articles and practical guides.

20 Kapitel knallhart recherchiert und vom Steuerprofi geprüft

Kostenlos herunterladen

Author - Sophia Merzbach

Sophia has been a key member of the Accountable team for many years, bringing a unique blend of journalistic precision and in-depth tax expertise to her work.

Who is Sophia ?Thank you for your feedback!

Useful

How much income tax is deducted from your income is largely determined by your tax class. There are ...

Read moreWorking as a self-employed professional has many advantages: You are your own boss and you can choos...

Read moreWorking with international clients can be tricky, depending on where exactly they’re located, whet...

Read moreFür mich als Kleinunternehmer ist der Preis ein bisschen hoch, aber für alles, was ich bekomme: alle Übersichten von Einnahmen und Ausgaben, die Funktionen rund um das Auto... ist es einfach top. Und das letzte Update zu den wiederkehrenden Ausgaben war hervorragend! Dankeschön.

Ardalan Zamanimehr

Die App ist super! Intuitiv und perfekt für Selbstständige. Leider ist meine Position noch zu exotisch für Accountable um genau diese Leichtigkeit auch in Anspruch zu nehmen. Es gibt noch keine einfache Lösung für Selbstständige mit zwei Steuernummern da zwei Berufe. Sollte sich das mal ändern, Wechsel ich von meinem Steuerberater wieder zu Accountable!

Viktor Rosin

Sehr freundlich und gezielte , verständliche Angaben und Erklärungen

Pascal Koopmann

Auf meine Anfrage habe ich sehr schnell eine sehr nette und kompetente Antwort bekommen. Die Mitarbeiterin hat mein als Verbesserungsvorschlag weitergegeben - und schon nach kurzer Zeit kam die Antwort, dass das entsprechende Feature eingearbeitet wurde. Tolle Arbeit!

Dr. Annika Krummacher

Sehr nette und kompetente Beratung - vielen Dank!

Annika Schirmer

Sehr gute App sehr einfach zu verstehen und leichte Bedienung

Johannes Sen

Schnelle Antwort mit Hilfestellung die das Problem sofort gelöst hat. Danke

Albert Friedrich Vontz

Meine Erfahrung mit Accountable ist wirklich klasse! Alles ist sehr übersichtlich und gut strukturiert und das Wichtigste: es funktioniert wie es soll! Es gibt online Webinare, einen KI Steuerberater der Zugriff auf die persönlichen Dokumente hat und die Steuer Coaches von welchen ich extrem begeistert bin. Sehr klare, ausführliche, vorausschauende und freundliche Antworten auf meine Fragen. Als selbsständiger Dienstleister fühle ich mich sehr gut aufgehoben und kann Accountable nur empfehlen.

Sven Schöffel

Ich finde es gut, dass ich als Kunde des Max Plans jetzt deutlich schnellere Antworten bekomme. Das war eine Zeit lang nicht zuverlässig so, umso positiver fällt mir die Verbesserung auf. Die Steuer Coaches sind stets bemüht zu helfen. Sie antworten freundlich, klar und lösungsorientiert. Ich bin damit wirklich sehr happy. Für mich war es außerdem die beste Entscheidung, meine Steuer selbst zu machen. Ich habe jetzt mehr Überblick über meine Zahlen und verstehe die Abläufe besser. Dadurch fühle ich mich deutlich sicherer, auch in der Kommunikation mit den Steuerbehörden. Ich kann Rückfragen schneller einordnen und gezielter reagieren. Das nimmt mir viel Stress und gibt mir das Gefühl, die Kontrolle zu haben. Der Live Call ist ein sinnvoller Zusatz. Du kannst offene Punkte direkt klären, ohne lange hin und her zu schreiben. Das spart Zeit und bringt schnell Klarheit. Fazit: Liebs 😊

Marco Richter

Top Team! Top Service!

Anonym